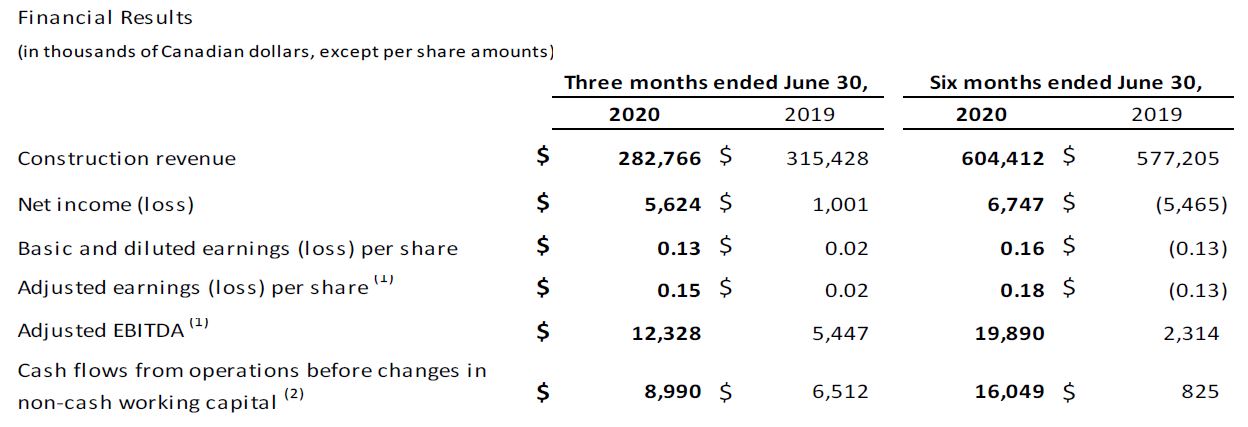

During the second quarter of 2020, the Company recorded net income of $5.6 million on construction revenue of$282.8 million compared with a net income of $1.0 million on $315.4 million of construction revenue in 2019. Basic and diluted earnings per share in the second quarter of 2020 and 2019 was $0.13 and $0.02, respectively. Volume was slightly lower, however gross profit improved significantly year-over-year driven by growth in the industrial work program. The year-over-year increase in second quarter net income is primarily attributable to the mix of the higher margin industrial work program. The second quarter of 2020 included approximately $1.3 million of pre-tax acquisition costs related to the due diligence and agreement to acquire Stuart Olson Inc. (“SOX”) that was announced subsequent to quarter end.

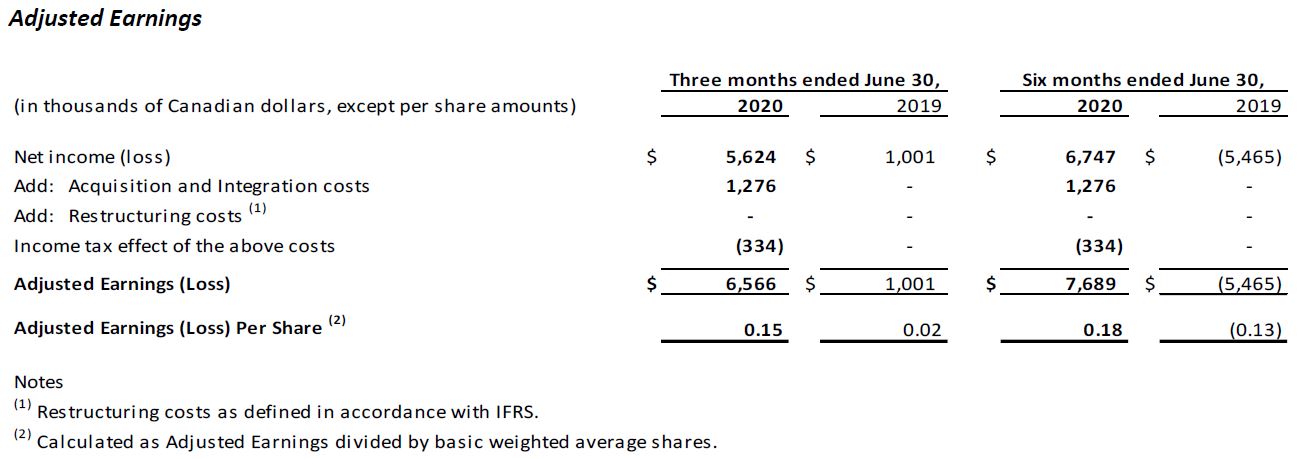

Adjusted Earnings and Adjusted Earnings Per Share in the second quarter of 2020 were $6.6 million and $0.15, respectively, compared with Adjusted Earnings and Adjusted Earnings Per Share in the second quarter of 2019 of$1.0 million and $0.02, respectively. The year-over-year increase in second quarter Adjusted Earnings is reflective of the improvement in earnings attributable to the mix of higher margin industrial work program.

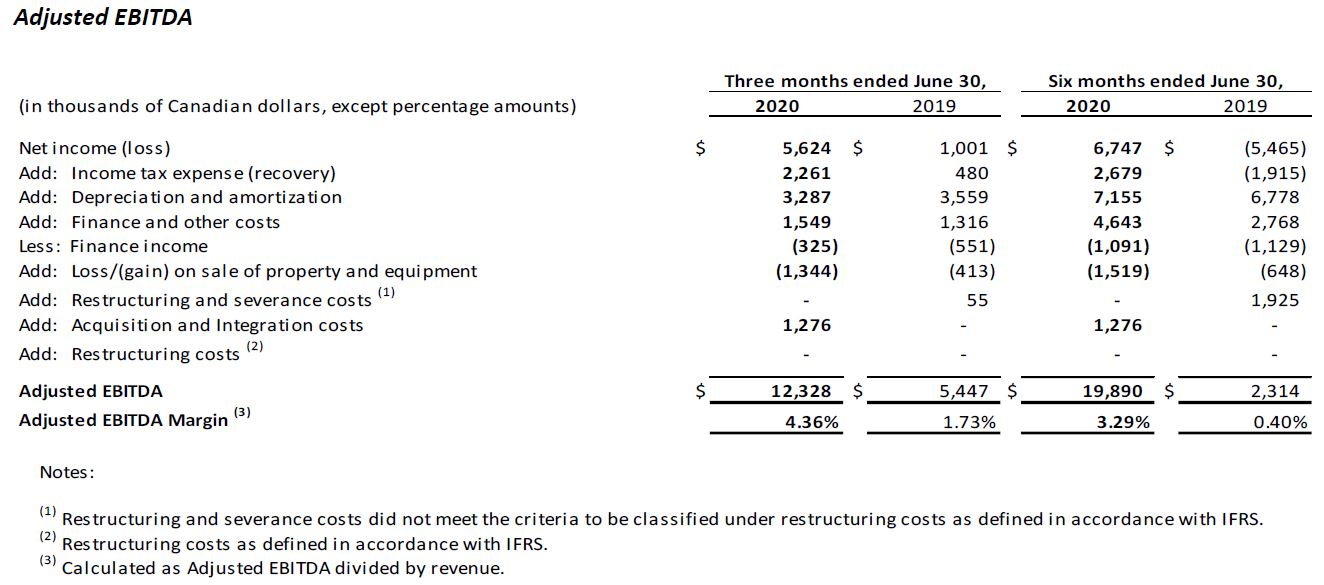

Adjusted EBITDA and Adjusted EBITDA Margin in the second quarter of 2020 were $12.3 million and 4.36%, respectively. Adjusted EBITDA increased $6.9 million from the Adjusted EBITDA of $5.4 million in the second quarter of 2019. Adjusted EBITDA Margin increased 263 basis points from the Adjusted EBITDA margin of 1.73% recorded in the second quarter of 2019. The year-over-year improvement was driven by an increase in gross profit due to the revenue mix, and the impact of increased costs on a certain contract incurred in 2019 that did not recur in 2020.

During the first half of 2020, the Company recorded net income of $6.7 million on construction revenue of $604.4 million compared with a net loss of $5.5 million on $577.2 million of construction revenue in 2019. Basic and diluted earnings per share in the first half of 2020 and 2019 were $0.16 and a loss of $0.13, respectively. The 4.7% year-over-year increase in revenue was driven by growth in the industrial work program, while the commercial and institutional work program was effectively flat. The year-over-year increase in net income is primarily attributable to the mix of the higher margin industrial work program. The first half of 2019 was negatively impacted by a Public Private Partnership (“PPP”) project that incurred additional cost due to design related scope growth and acceleration expenses. There were substantial changes to the scope of the project requested by the client that are in commercial negotiation. This PPP project achieved substantial performance in the first quarter of 2020.

Adjusted Earnings and Adjusted Earnings Per Share in the first half of 2020 were $7.7 million and $0.18, respectively, compared with an Adjusted Loss of $5.5 million and Adjusted Loss Per Share of $0.13 in the first half of 2019. The year-over-year increase in second quarter net income is reflective of the improvement in earnings attributable to the mix of the higher margin industrial work program and the previously described PPP project.

Adjusted EBITDA year-to-date at June 30, 2020 was $19.9 million compared to $2.3 million in the comparable period in 2019. Adjusted EBITDA Margin during the first half of 2020 was 3.29% and increased 289 basis points from the 0.40% recorded in the first half of 2019. The year-over-year improvement was driven by an increase in gross profit due to the revenue mix, and the impact of increased costs on a certain contract incurred in 2019 that did not recur in 2020.

The COVID-19 pandemic has added uncertainty to the construction industry as each provincial government has responded with different measures to address the threat to public health. While certain preventative measures have eased in various provinces to varying degrees, the duration continues to be unknown and the corresponding impacts to our workforce, supply chain and project sites are key variables that have uncertainty as a result. The financial results of second quarter 2020 were impacted by the COVID-19 pandemic in April and early May when the Company experienced temporary project shutdowns and reduced productivity on project sites. The health and safety of employees is paramount and, as a result of the pandemic, the Company has increased health and safety initiatives such as physical distancing and added additional measures to normal safety protocols. The situation remains extremely fluid; however, the Company responded to the challenges presented in the first half of 2020 and is well-positioned to respond to fluctuating scenarios in the near term.

In 2020, the Company secured $702.4 million of new contract awards and change orders and executed $604.4 million of construction revenues. Backlog of $1,645.4 million at June 30, 2020, increased 19.3% from Backlog of $1,379.7 million at June 30, 2019. Backlog increased by $98.0 million, or 6.3% from the $1,547.4 million of Backlog recorded at December 31, 2019 despite some awards that were expected in the first half of 2020 being delayed as a result of the COVID-19 pandemic.

In the first six months of 2020, cash and cash equivalents decreased $8.9 million, before the effects of foreign exchange, to $171.5 million from $180.3 million at the end of 2019. Most of the changes in cash and equivalents during the period relate to changes in the non-cash net current asset/liability position which can fluctuate significantly in the normal course of business. During the second quarter, the Company repaid $16.3 million that it had drawn in the first quarter from one of its committed bank facilities for working capital purposes.

During the second quarter the Company was awarded several new projects and achieved substantial completion of certain contracts:

o Bird was awarded the Eric Hamber Secondary School Replacement Project in Vancouver, British Columbia for approximately $92 million, under a design-build contract.

o The Company was awarded a construction management services contract for 185 Enfield Place Project in Mississauga, Ontario for approximately $107 million for GWL Realty Advisors (“GWLRA”).

o The Company was awarded a stipulated sum contract for the Louvre Residence at Century Park Project (“Louvre”) in Edmonton, Alberta for approximately $57 million under development by Procura Real Estate Services Ltd.

o The Company signed a contract for construction at a liquefied natural gas (“LNG”) Liquefaction Export Terminal Facility located in northwestern British Columbia. The contract is for the construction of concrete foundations and paving inside the battery limits of the LNG trains process area and is one of the largest concrete foundation packages ever awarded to Bird. The contract will start immediately and continue into 2022.

o The Company achieved substantial completion for the Niagara Falls Entertainment Centre in the first half of 2020. Designed and constructed to LEED V4 standards, the new 5,000 seat facility features performance space with multiple stage configurations.

The Board has declared an eligible dividend of $0.0325 per common share for each of July, August, September and October 2020.

Subsequent to quarter end, the Company announced the sale of Bird Capital Limited’s 20 per cent interest in the P3 concessions responsible for 18 schools and nine childcare facilities in Saskatchewan to its project partner, Concert Infrastructure. Developed as the Saskatchewan Joint-Use Schools Project I (SJUSP I) and Saskatchewan Joint-Use Schools Project II (SJUSP II), the projects made up the largest school construction program in the history of the province at the time of construction.

Subsequent to quarter end, on July 29, 2020, the Company entered into a definitive arrangement agreement under which the Company will acquire all of the outstanding common shares of Stuart Olson Inc., pursuant to an arrangement under the Business Corporations Act (Alberta) for aggregate consideration of $96.5 million. The aggregate consideration of $96.5 million will consist of $30.0 million cash and $66.5 million of the common shares of Bird, based on the five-day volume weighted average trading price of the common shares of Bird ending July 17, 2020, of $6.32 per share. The proposed transaction, which was unanimously approved by the Boards of Directors of both companies, is expected to close early in the fourth quarter of 2020, subject to obtaining the required approvals of the Court of Queen’s Bench of Alberta, the Competition Bureau, the SOX shareholders, secured bank lenders and unsecured convertible debenture holders of Stuart Olson Inc., and other customary closing conditions.

In the first six months, cash flows from operations before changes in non-cash working capital of $16.0 million increased$15.2 million year-over-year from the $0.8 million cash generated in 2019 primarily due to the $12.2 million improvement in net income, a $4.6 million higher non-cash addback for income tax expense year-over-year, a $1.9 million higher non-cash addback of finance and other costs, partially offset by $2.2 million higher non-cash reduction for income from equity accounted investments.

Bird Construction Inc. also announced that its Board of Directors has approved monthly eligible dividends for the following months in the amount of $0.0325 per common share to be paid as follows:

i) The August dividend of $0.0325 per share will be paid on September 18, 2020 to the Shareholders of record as of the close of business on August 31, 2020.

ii) The September dividend of $0.0325 per share will be paid on October 20, 2020 to the Shareholders of record as of the close of business on September 30, 2020.

iii) The October dividend of $0.0325 per share will be paid on November 20, 2020 to the Shareholders of record as of the close of business on October 31, 2020.

Bird will host an investor webcast to discuss the quarterly results on Wednesday, August 12, 2020 at 10:00 a.m. ET, to discuss the quarterly results. Analysts and investors may connect to the webcast via URL at http://services.choruscall.ca/links/bird20200812.html. They may also dial 1-855-328-1925 for audio only or to enter the question queue, attendees are asked to be on the line 10 minutes prior to the start of the call. The presentation can also be found on our website at https://www.bird.ca/investors/publications#investor-presentations.

Related financial documents will be filed and available on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com.

Non-GAAP Measures

Adjusted Earnings, Adjusted Earnings Per Share, Adjusted EBITDA and Adjusted EBITDA Margin have no standardized meaning under IFRS and are considered non-GAAP measures. Therefore, these measures may not be comparable with similar measures presented by other companies. Management uses Adjusted Earnings and Adjusted EBITDA to assess the operating performance of its business. Management believes that investors and analysts use these measures, as they may provide predictive value to assess the ongoing operations of the business and a more consistent comparison between financial reporting periods.

Forward Looking Information

This news release contains forward-looking statements and information ("forward-looking statements") within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this news release are based on the expectations, estimates and projections of management of Bird as of the date of this news release unless otherwise stated. The use of any of the words "believe", "expect", "anticipate", "contemplate", "target", "plan", "intends", "continue", "may", "will", "should" and similar expressions are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning: the timing and anticipated receipt of required lender, debenture holder, shareholder, court, regulatory, stock exchange and other third party approvals for the transaction; and the ability of Stuart Olson and Bird to satisfy the other conditions to, and to complete, the transaction.

n respect of the forward-looking statements concerning the completion of the transaction, the timing and anticipated receipt of required third party approvals and the anticipated timing for completion of the transaction, Bird and Stuart Olson have provided such in reliance on certain assumptions that they believe are reasonable at this time, including assumptions as to the time required to prepare and mail shareholder meeting materials, including the Circular; the ability of the parties to receive, in a timely manner, the necessary lender, debenture holder, shareholder, court, regulatory, stock exchange and other third party approvals, including but not limited to the receipt of applicable competition approvals; and the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Arrangement Agreement.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to the risks associated with the industries in which Bird operates in general such as: operational risks, industry and inherent project delivery risks; delays or changes in plans with respect to growth projects or capital expenditures; costs and expenses; health, safety and environmental risks; commodity price, interest rate and exchange rate fluctuations; compliance with environmental laws risks; competition, ethics and reputational risks; ability to access sufficient capital from internal and external sources; global pandemics; repayment of credit facility; collection of recognized revenue; performance bonds and contract security; potential for non-payment and credit risk and ongoing financing availability; regional concentration; regulations; dependence on the public sector; client concentration; labour matters; loss of key management; ability to hire and retain qualified and capable personnel; subcontractor performance; unanticipated shutdowns, work stoppages, strikes and lockouts; maintaining safe worksites; cyber security risks; litigation risk; corporate guarantees and letters of credit; volatility of market trading; failure of clients to obtain required permits and licenses; payment of dividends; economy and cyclicality; Public Private Partnerships project risk; design risks; completion and performance guarantees/design-build risks; ability to secure work; estimating costs and schedules/assessing contract risks; quality assurance and quality control; accuracy of cost to complete estimates; insurance risk; adjustments and cancellations of backlog; joint venture risk; internal and disclosure controls; Public Private Partnerships equity investments; and changes in legislation, including but not limited to tax laws and environmental regulations. Risks and uncertainties inherent in the nature of the transaction include the failure of Stuart Olson or Bird to obtain, as applicable, necessary lender, debenture holder, shareholder, court, regulatory, stock exchange and other third party approvals, or to otherwise satisfy the conditions to the transaction, in a timely manner, or at all. Failure to so obtain such approvals, or the failure of Stuart Olson or Bird to otherwise satisfy the conditions to the transaction, may result in the transaction not being completed on the proposed terms, or at all. In addition, the failure of Stuart Olson or Bird to comply with the terms of the Arrangement Agreement may result in Stuart Olson or Bird being required to pay a non-completion or other fee to the other party.

The forward-looking statements in this news release should not be interpreted as providing a full assessment or reflection of the unprecedented impacts of the recent COVID-19 pandemic ("COVID-19") and the resulting indirect global and regional economic impacts.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of the parties, and the combined company, including any risk factors related to COVID-19, are included in reports on file with applicable securities regulatory authorities, including but not limited to; Bird's Annual Information Form for the year ended December 31, 2019, which may be accessed on Bird's SEDAR profile at www.sedar.com.

The forward-looking statements contained in this news release are made as of the date hereof and the parties undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

For further information contact:

T.L. McKibbon, President & C.E.O or

W.R. Gingrich, C.F.O

Bird Construction Inc.

5700 Explorer Drive, Suite 400

Mississauga, ON, L4W 0C6

Phone: (905) 602-4122 Fax: (905) 602-1516