COMPANY: BIRD CONSTRUCTION INC.

LISTING: TORONTO STOCK EXCHANGE

CITY: MISSISSAUGA

SYMBOL: BDT

DATE: March 9, 2021

SUBJECT: BIRD CONSTRUCTION INC. ANNOUNCES 2020 FOURTH QUARTER AND ANNUAL FINANCIAL RESULTS

“I am proud to report strong fourth quarter and full-year 2020 results in spite of the challenges presented by the global pandemic,” said Teri McKibbon, President and CEO, Bird Construction. “I particularly want to recognize the employees on our project sites who have worked tirelessly throughout to safely deliver our project commitments. The Bird team’s unwavering dedication to our company, clients and projects over this challenging period allowed us to post strong revenue and profitability growth for the fourth quarter and full-year 2020, marking our ninth straight quarter of trailing twelve month Adjusted EBITDA margin improvement.”

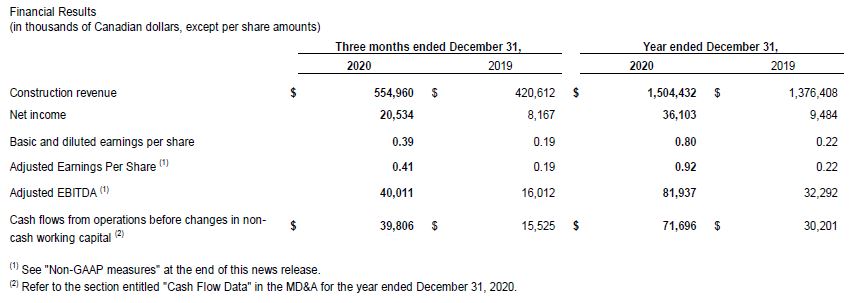

FINANCIAL HIGHLIGHTS

Fourth Quarter 2020 compared to Fourth Quarter 2019

Construction revenue of $555.0 million, representing a 31.9% increase year-over-year.Net income and earnings per share were $20.5 million and $0.39, respectively, compared to $8.2 million and $0.19 in Q4 2019.Adjusted Earnings and Adjusted Earnings Per Share were $21.5 million and $0.41, respectively, compared to $8.2 million and $0.19 in Q4 2019.Adjusted EBITDA of $40.0 million, or 7.2% of revenues, reflects a 149.9% increase in Adjusted EBITDA and a 340 bps improvement in Adjusted EBITDA Margin.

Full-Year 2020 compared to Full-Year 2019

Construction revenue of $1,504.4 million, representing a 9.3% increase year-over-year.Net income and earnings per share were $36.1 million and $0.80, respectively, compared to $9.5 million and $0.22 in 2019.Adjusted Earnings and Adjusted Earnings Per Share were $41.6 million and $0.92, respectively, compared to $9.5 million and $0.22 in 2019.Adjusted EBITDA of $81.9 million, or 5.5% of revenues, reflects a 153.7% increase in Adjusted EBITDA and a 310 bps improvement in Adjusted EBITDA Margin year-over-year.Record Backlog of $2,682.5 million and Pending Backlog of $1,635.9 million at year end.Retained a strong balance sheet with $135.5 million of working capital and $156.9 million of non-restricted cash.

“The fourth quarter also represents the first full quarter Stuart Olson was integrated within Bird’s results since completing the acquisition late in the third quarter of 2020. I am pleased to report Stuart Olson contributed positively to the bottom line in Q4 2020 and expect the same in 2021. The integration is on track and the amalgamation of the two companies has provided Bird significant bench strength, cross-selling opportunities and cost synergies. All told, the combination of our efforts has resulted in a more resilient business model as we have further de-risked our backlog and diversified our work programs,” added Mr. McKibbon. “The strength of the underlying business we have created, along with our strong balance sheet and the pursuit of accretive, profitable growth positions the Company to create long-term value for all stakeholders for decades to come.”

OVERVIEW

• The Company completed its acquisition of Stuart Olson Inc. (“Stuart Olson”) on September 25, 2020 and welcomed the additional employees, clients, shareholders and all other stakeholders to this dynamic organization and new leading construction company. The business combination is the largest and most transformative transaction in the Company’s 100 year history. It creates additional opportunity for our people and our customers, and Bird is well-positioned to play a major role in the Canadian construction industry, creating long-term value for all stakeholders for decades to come.

• The COVID-19 pandemic has added uncertainty to the construction industry as each provincial government has responded with different measures to address the continuing and evolving threat to public health. Bird has seen delays in project tenders and awards from clients, and experienced reduced productivity on project sites as a result of increased safety protocols implemented during the pandemic. Throughout 2020, the Company experienced delays in smaller sized or short-term projects in locations such as Manitoba and Atlantic Canada. The health and safety of employees is paramount and, as a result of the pandemic, the Company has increased health and safety initiatives such as physical distancing and added additional measures to normal safety protocols. During the early stages of the pandemic in 2020, the Company made a difficult decision and instituted mandatory wage reductions to its employees to preserve the financial health of the business and keep it agile through the pandemic. With the Canada Emergency Wage Subsidy (“CEWS”) enacted by the federal government, the Company was ultimately able to restore and reimburse its employees for the reduced wages in 2020. The situation remains fluid; however, the Company responded to the challenges presented in 2020 and is well-positioned to respond to fluctuating scenarios in the near term.

• During the fourth quarter of 2020, the Company recorded net income of $20.5 million on construction revenue of $555.0 million compared with net income of $8.2 million on $420.6 million of construction revenue in 2019. Basic and diluted earnings per share in the fourth quarter of 2020 and 2019 was $0.39 and $0.19, respectively. The year-over-year increase in fourth quarter revenue is primarily attributable to the inclusion of Stuart Olson. The year-over-year increase in net income is a combination of the addition of Stuart Olson and the timing of applications for CEWS. The Company recognized a total pre-tax compensation expense recovery of $21.7 million in the fourth quarter of 2020, of which approximately $11.6 million relates to the first nine months of 2020 ($0.4 million first quarter 2020, $3.8 million second quarter 2020, and $7.4 million third quarter 2020). Although the timing of recording the CEWS benefit was a significant factor affecting fourth quarter net income, on a full year basis CEWS did not fully offset the negative impact which COVID-19 had on revenues and margins.

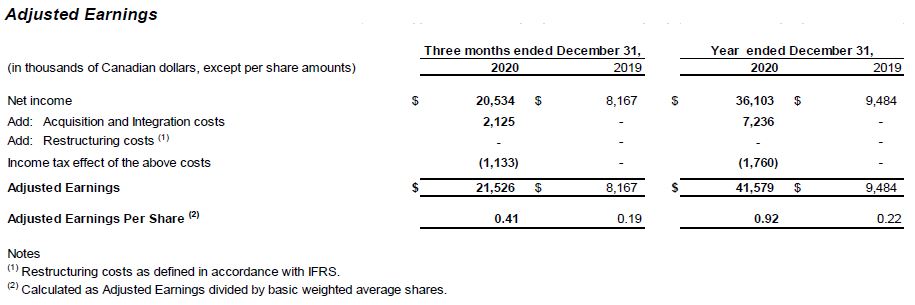

• Adjusted Earnings and Adjusted Earnings Per Share in the fourth quarter of 2020 were $21.5 million and $0.41, respectively, compared with Adjusted Earnings and Adjusted Earnings Per Share in the fourth quarter of 2019 of $8.2 million and $0.19, respectively. The year-over-year increase in fourth quarter Adjusted Earnings is reflective of the improvement in earnings attributable to the inclusion of Stuart Olson and the year to date catch up in the application for CEWS.

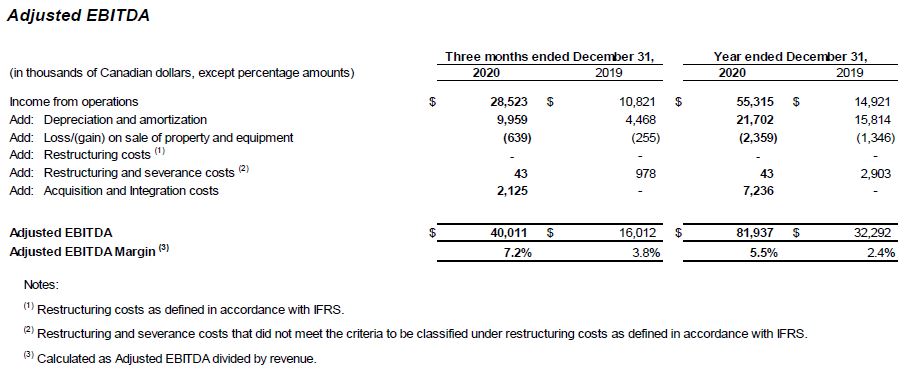

• Adjusted EBITDA and Adjusted EBITDA Margin in the fourth quarter of 2020 were $40.0 million and 7.2%, respectively. Adjusted EBITDA increased $24.0 million from the Adjusted EBITDA of $16.0 million in the fourth quarter of 2019. Adjusted EBITDA Margin increased 340 basis points from the Adjusted EBITDA margin of 3.8% recorded in the fourth quarter of 2019.

• In 2020, the Company recorded net income of $36.1 million on construction revenue of $1,504.4 million compared with a net income of $9.5 million on $1,376.4 million of construction revenue in 2019. Basic and diluted earnings per share in 2020 and 2019 were $0.80 and $0.22, respectively. There was an increase in revenue year-over-year due to the inclusion of fourth quarter revenue of Stuart Olson. Excluding the revenue contribution from Stuart Olson, the Company experienced a year-over-year revenue decline in the second, third and fourth quarters of 2020 attributable to the COVID-19 pandemic. The year-over-year increase in net income is primarily attributable to the mix of the higher margin industrial work program and the acquisition of Stuart Olson. An additional significant factor contributing to the year-over-year improvement in net income was the Company's increased contract pursuit selectivity in its institutional and Public Private Partnership (“PPP”) business, targeting lower risk opportunities best aligned with execution capabilities. Thereby avoiding notable underperforming contracts which resulted in headwinds to margins and income in recent years. 2019 net income was negatively impacted by a PPP project that incurred additional cost due to design related scope growth and acceleration expenses. There were substantial changes to the scope of the project requested by the client that are in commercial negotiation. This PPP project achieved substantial performance in the first quarter of 2020.

• Adjusted Earnings and Adjusted Earnings Per Share for fiscal 2020 were $41.6 million and $0.92, respectively, compared with $9.5 million and $0.22 respectively, in fiscal 2019. The year-over-year increase in Adjusted Earnings was due to the same reasons noted above that increased net income.

• Adjusted EBITDA for fiscal 2020 was $81.9 million compared to $32.3 million in the comparable period in 2019. Adjusted EBITDA Margin in 2020 was 5.5% and increased 310 basis points from the 2.4% recorded in 2019. The year-over-year improvement was driven by an increase in gross profit due to the revenue mix, the inclusion of Stuart Olson fourth quarter earnings, and the previously described Company's increased contract pursuit selectivity, targeting lower risk opportunities best aligned with execution capabilities.

• In 2020, the Company secured $1,643.8 million of new contract awards and change orders and executed $1,504.4 million of construction revenues, and $995.7 million of Backlog was contributed at the acquisition date by recently acquired Stuart Olson. Backlog of $2,682.5 million at December 31, 2020 increased 73.4% from Backlog of $1,547.4 million at December 31, 2019. Included in Backlog is a $154.0 million design-build contract for the Nanaimo Correctional Centre (“NCC”) Replacement Project in Nanaimo, British Columbia. The NCC Replacement Project features modernized spaces for educational, vocational, and certified trades training in addition to rehabilitative and culturally responsive Indigenous programming. It also includes Vancouver Island’s first provincial custody capacity for women. Two local First Nations, Snuneymuxw and Snaw’Naw’As, will also have input into the design as well as job and contract opportunities during construction.

• In 2020, cash and cash equivalents increased $31.8 million, before the effects of foreign exchange, to $212.1 million from $180.3 million at the end of 2019. The majority of the change in cash and equivalents during the period relate to changes in the non-cash net current asset/liability position which can fluctuate significantly in the normal course of business. Cash flows from operations generated cash of $128.9 million mainly due to changes in non-cash working capital, including a $75.1 million increase as a result of the substantial completion of an alternative finance project in the fourth quarter of 2020. Cash flows from investing activities used cash of $53.9 million mainly related to the purchase of Stuart Olson. Cash flows from financing activities used cash of $43.3 million mainly due to the net repayment of non-recourse project financing related to an alternative finance project offset by net credit facility draws and the share issuance related to the purchase of Stuart Olson.

• The Board has declared an eligible dividend of $0.0325 per common share for each of March 2021 and April 2021.

• Subsequent to fiscal 2020 year-end, the Company announced that it has been awarded the following projects and contracts:

o A five-year contract valued in excess of $550.0 million to provide MRO services for a longstanding industrial customer in Alberta. Under the terms of the multi-site, multi-use agreement, the Industrial Maintenance team will deliver a multi-disciplined offering for maintenance services, turnarounds and sustaining capital construction projects, drawing on the full suite of services of both Stuart Olson and Bird. Estimated 2021 revenues will be recorded into Backlog in the first quarter of 2021; the remaining value of the contract was recorded in Pending Backlog.

o A contract was signed with Infrastructure Ontario for the design-build expansion at the Kenora Jail and the Thunder Bay Correctional Centre. The project will leverage the Company’s integrated conventional site construction and innovative modular construction solutions through Bird’s valued partnership with Stack Modular. The Company’s teams in Manitoba and Ontario will bring together experience and local expertise, reaffirming Bird’s commitment to building meaningful partnerships with regional communities including engagement with local Indigenous communities.

CONFERENCE CALL AND WEBCAST

Bird will host an investor webcast to discuss the quarterly results on Wednesday, March 10, 2021 at 10:00 a.m. ET, to discuss the Company’s quarterly and annual results. Analysts and investors may connect to the webcast via URL at http://services.choruscall.ca/links/bird20210310.html. They may also dial 1-855-328-1925 for audio only or to enter the question queue, attendees are asked to be on the line 10 minutes prior to the start of the call. The presentation can also be found on our website at https://www.bird.ca/investors/publications-archive.

Related financial documents will be filed and available on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com.

NON-GAAP MEASURES

Adjusted Earnings, Adjusted Earnings Per Share, Adjusted EBITDA, and Adjusted EBITDA Margin have no standardized meaning under IFRS and are considered non-GAAP measures. Therefore, these measures may not be comparable with similar measures presented by other companies.

Management uses Adjusted Earnings and Adjusted EBITDA to assess the operating performance of its business. Management believes that investors and analysts use these measures, as they may provide predictive value to assess the ongoing operations of the business and a more consistent comparison between financial reporting periods.

Adjusted Earnings and Adjusted EBITDA are reconciled as follows:

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and information ("forward-looking statements") within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this news release are based on the expectations, estimates and projections of management of Bird as of the date of this news release unless otherwise stated. The use of any of the words "believe", "expect", "anticipate", "contemplate", "target", "plan", "intends", "continue", "may", "will", "should" and similar expressions are intended to identify forward- looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning: the anticipated benefits of the acquisition to Bird, its shareholders, and all other stakeholders, including anticipated synergies; and the plans and strategic priorities of the combined company.

In respect of the forward-looking statements concerning the anticipated benefits of the acquisition, Bird has provided such in reliance on certain assumptions that it believes are reasonable at this time, including in respect of the combined company's services and anticipated synergies, capital efficiencies and cost- savings.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to the risks associated with the industries in which Bird and Stuart Olson operate in general such as: operational risks, industry and inherent project delivery risks; delays or changes in plans with respect to growth projects or capital expenditures; costs and expenses; health, safety and environmental risks; commodity price, interest rate and exchange rate fluctuations; compliance with environmental laws risks; competition, ethics and reputational risks; ability to access sufficient capital from internal and external sources; global pandemics; repayment of credit facility; collection of recognized revenue; performance bonds and contract security; potential for non-payment and credit risk and ongoing financing availability; regional concentration; regulations; dependence on the public sector; client concentration; labour matters; loss of key management; ability to hire and retain qualified and capable personnel; subcontractor performance; unanticipated shutdowns, work stoppages, strikes and lockouts; maintaining safe worksites; cyber security risks; litigation risk; corporate guarantees and letters of credit; volatility of market trading; failure of clients to obtain required permits and licenses; payment of dividends; economy and cyclicality; Public Private Partnerships project risk; design risks; completion and performance guarantees/design-build risks; ability to secure work; estimating costs and schedules/assessing contract risks; quality assurance and quality control; accuracy of cost to complete estimates; insurance risk; adjustments and cancellations of backlog; joint venture risk; internal and disclosure controls; Public Private Partnerships equity investments; failure to realize the anticipated benefits of the Transaction; and changes in legislation, including but not limited to tax laws and environmental regulations.

The forward-looking statements in this news release should not be interpreted as providing a full assessment or reflection of the unprecedented impacts of the recent COVID-19 pandemic ("COVID-19") and the resulting indirect global and regional economic impacts.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of the parties, and the combined company, including any risk factors related to COVID-19, are included in reports on file with applicable securities regulatory authorities, including but not limited to; Stuart Olson's Annual Information Form for the year ended December 31, 2019 and most recently filed Management’s Discussion and Analysis and Bird's Annual Information Form for the year ended December 31, 2020 and most recently filed Management’s Discussion and Analysis, each of which may be accessed on Stuart Olson's and Bird's SEDAR profile, respectively, at www.sedar.com.

The forward-looking statements contained in this news release are made as of the date hereof and the parties undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

For further information, please contact:

T.L. McKibbon, President & CEO or

W.R. Gingrich, CFO

Bird Construction Inc.

5700 Explorer Drive, Suite 400

Mississauga, ON L4W 0C6

Phone: (905) 602-4122

ABOUT BIRD CONSTRUCTION

Bird (TSX:BDT) is a leading Canadian construction company operating from coast-to-coast and servicing all of Canada’s major markets. Bird provides a comprehensive range of construction services from new construction for industrial, commercial, and institutional markets; to industrial maintenance, repair and operations services, heavy civil construction, and contract surface mining; as well as vertical infrastructure including, electrical, mechanical, and specialty trades. For over 100 years, Bird has been a people-focused company with an unwavering commitment to safety and a high level of service that provides long-term value for all stakeholders. www.bird.ca